How do banks create money and why can other firms not do the same?

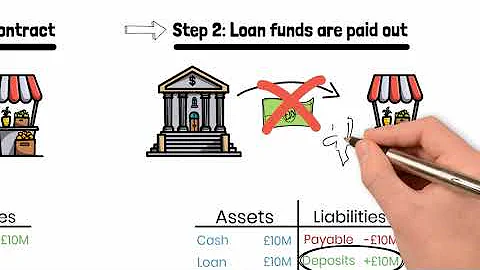

Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower's bank account, thereby creating new money.” In short, money exists as bank deposits – IOUs of commercial banks – and is created through some simple accounting whenever a bank makes a loan.

Banks create money when they lend the rest of the money depositors give them. This money can be used to purchase goods and services and can find its way back into the banking system as a deposit in another bank, which then can lend a fraction of it.

Banks are financial institutions that are licensed to provide loan products and receive deposits; non-banking institutions cannot do this. Financial services include insurance, the facilitation of payments, wealth management, and retirement planning.

The answer is that they can and do, but they're not just taking money from customers' bank accounts. Banks can generate revenue from interest paid on loans, raising common stock if they're publicly traded, as well as various fees for services, but these aren't the only ways in which a bank can make money.

They earn interest on the securities they hold. They earn fees for customer services, such as checking accounts, financial counseling, loan servicing and the sales of other financial products (e.g., insurance and mutual funds).

According to the fractional reserve theory of banking, individual banks are mere financial intermediaries that cannot create money, but collectively they end up creating money through systemic interaction.

- Case example: Bank of America.

- Step 1: Know the Business.

- Step 2: Write a business plan.

- Step 3: Raise capital.

- Step 4: Get a charter.

- Step 5: Apply for FDIC approval.

- Step 6: Check for any other necessary permits.

- Step 7: Get customers.

There are _____ main ways banks make money: by charging interest on money that they lend, by charging fees for services they provide and by trading financial instruments in the financial markets.

The primary difference between banking and finance is that banking is a specific subset of finance. While banking is focused on managing deposits, loans, and other financial products and services provided by banks, finance encompasses a broader range of activities related to managing money and investments.

Just like any other business, the goal of a bank is to earn a profit for its owners. For most banks, the owners are their shareholders. Banks do this by charging more interest on the loans and other debt they issue to borrowers than they pay to people who use their savings vehicles.

How does a commercial bank create money?

Commercial banks perform the function of credit creation in an economy. Therefore, the money that is created by commercial banks is known as credit money. This is achieved by the commercial banks in the form of purchasing securities and providing loans.

Commercial banks borrow from the Federal Reserve System (FRS) to meet reserve requirements or to address a temporary funding problem. The Fed provides loans through the discount window with a discount rate, the interest rate that applies when the Federal Reserve lends to banks.

Banks make their money in a variety of ways, but most can be classified as either fees or interest income. Let's take a look at fees first. There are many different types of fees banks can collect, both on the commercial banking and investment banking sides of the business.

Credit card issuers make money from the interest they charge consumers when they carry a balance. The amount of interest they charge individual consumers depends on their creditworthiness, but interest rates also ebb and flow over time based on market conditions.

Banks primarily make money from the interest on loans and the fees they charge their customers. These fees can be tied to specific products, such as bank accounts or related to financial services. For example, an investment bank that offers portfolio management to investors can charge a fee for that service.

Investments. Banks also generate revenue by investing in various financial products. This can include stocks, bonds, mutual funds, and other securities. By investing their depositors' money, banks can earn returns that contribute to their overall profitability.

At the moment of deposit, the funds become the property of the depository bank. Thus, as a depositor, you are in essence a creditor of the bank. Once the bank accepts your deposit, it agrees to refund the same amount, or any part thereof, on demand.

You will need to get licensed as a business and apply for a banking charter from the state in order to open your bank. It's important to make sure that you are properly registered with all of the necessary government agencies before you start operations.

“I want to own a bank — how much capital would I need to start?” The question is one that more and more wealthy people are considering because of the great benefits of owning a bank. Most startup banks require anywhere from $12 million to $20 million to open the doors, but that figure is just the beginning.

How Much Do Bank Owner Jobs Pay per Year? $26,500 is the 25th percentile. Salaries below this are outliers. $125,000 is the 75th percentile.

How much does it cost to start a bank in South Africa?

Applicants proposing to operate as banks or subsidiaries/branches of foreign banks (hereinafter collectively referred to as banks) must have a minimum capital of R250 million. Applicants proposing to operate as mutual banks must have a minimum capital of R10 million.

Bankers often have degrees in business management, finance, economics, or mathematics and can begin their career after graduating with a bachelor's. There are several career paths within banking including investment banking, personal banking, wealth management, and bank management.

Banks create money by making loans. A bank loans or invests its excess reserves to earn more interest. A one-dollar increase in the monetary base causes the money supply to increase by more than one dollar. The increase in the money supply is the money multiplier.

Interest rates and bank profitability are connected, with banks benefiting from higher interest rates. When interest rates are higher, banks make more money by taking advantage of the greater spread between the interest they pay to their customers and the profits they earn by investing.

In most modern economies, money is created by both central banks and commercial banks. Money issued by central banks is termed reserve deposits and is only available for use by central bank accounts holders, which is generally large commercial banks and foreign central banks.

References

- https://www.forbes.com/advisor/banking/largest-banks-in-the-us/

- https://www.sgrlaw.com/does-the-money-in-your-bank-account-really-belong-to-you/

- https://www.albany.edu/~bd445/Economics_350_Money_and_Banking_Slides_Spring_2013/Money_Multiplier.pdf

- https://www.wgu.edu/career-guide/business/banker-career.html

- https://www.investopedia.com/ask/answers/072815/why-do-commercial-banks-borrow-federal-reserve.asp

- https://www.forbes.com/sites/forbesfinancecouncil/2023/11/02/what-is-money-examining-its-role-in-society/

- https://www.lendingclub.com/resource-center/personal-savings/fdic-vs-ncua-insurance-are-banks-or-credit-unions-safer

- https://finance.yahoo.com/news/check-2-bills-could-worth-153919942.html

- https://www.quora.com/What-is-the-most-profitable-sector-of-banking

- https://homework.study.com/explanation/explain-how-banks-are-able-to-create-money-in-a-multiple-bank-system-what-factors-determine-the-ability-of-the-banks-to-create-money-what-is-the-money-multiplier-what-determines-the-value-of-the-in.html

- https://www.moneylife.in/article/cos-need-minimum-capital-of-rs500-crore-to-set-up-a-bank-rbi/19322.html

- https://www.linkedin.com/pulse/best-things-life-free-chakraborty-s-chakraborty

- https://byjus.com/question-answer/explain-the-functions-of-a-commercial-bank-1/

- https://www.americanbullion.com/can-banks-seize-your-money/

- https://www.investopedia.com/ask/answers/012615/why-would-you-keep-funds-money-market-account-and-not-savings-account.asp

- https://www.investopedia.com/terms/s/savingsaccount.asp

- https://bankingtruths.com/becoming-your-own-banker-explained/

- https://www.experian.com/blogs/ask-experian/pros-and-cons-of-savings-accounts/

- https://en.wikipedia.org/wiki/Money_creation

- https://corporatefinanceinstitute.com/resources/economics/how-do-banks-make-money/

- https://wonderopolis.org/wonder/how-much-money-can-a-bank-hold

- https://byjus.com/commerce/credit-creation-by-commercial-bank/

- https://www.bep.gov/currency/how-money-is-made

- https://www.imf.org/external/pubs/ft/fandd/2012/09/basics.htm

- https://www.upflip.com/blog/how-to-start-a-bank

- https://money.howstuffworks.com/start-bank.htm

- https://vaulted.com/nuggets/what-backs-the-united-states-dollar/

- https://positivemoney.org/how-money-works/proof-that-banks-create-money/

- https://www.fool.com/the-ascent/banks/articles/is-10000-too-much-to-keep-in-a-savings-account/

- https://www.investopedia.com/terms/b/bank.asp

- https://byjus.com/commerce/functions-of-commercial-banks/

- https://www.mas.gov.sg/-/media/Digital-Bank-Licence/Eligibility-Criteria-and-Requirements-for-Digital-Banks.pdf

- https://smartasset.com/investing/where-do-billionaires-keep-their-money

- https://www.investopedia.com/terms/c/commercialbank.asp

- https://smartasset.com/financial-advisor/where-do-millionaires-keep-their-money

- https://www.newyorkfed.org/research/epr/02v08n1/0205benn/0205benn.html

- https://www.forbes.com/advisor/banking/cds/are-cds-worth-it/

- https://www.brookings.edu/articles/what-is-bank-capital-what-is-the-basel-iii-endgame/

- https://www.businessinsider.com/personal-finance/7-percent-interest-savings-accounts

- https://www.quora.com/What-would-happen-if-money-became-worthless

- https://www.thestreet.com/personal-finance/banks-most-at-risk-morningstar

- https://www.statista.com/statistics/421215/banks-assets-globally/

- https://medium.com/illumination/could-you-live-in-a-world-where-money-didnt-exist-986521ebd5f0

- https://www.businessinsider.com/personal-finance/best-banks

- https://www.sofi.com/learn/content/how-do-banks-make-money/

- https://www.incauthority.com/blog/how-to-start-a-bank/

- https://econpapers.repec.org/RePEc:eee:finana:v:36:y:2014:i:c:p:1-19

- https://www.moneyhelper.org.uk/en/savings/investing/peer-to-peer-lending-what-you-need-to-know

- https://medium.com/illumination/why-money-matters-everything-everywhere-in-todays-world-cc6c2719830a

- https://www.lloydsbank.com/accountopeningguide.html

- https://www.bankrate.com/banking/what-is-a-bank-run/

- https://www.khanacademy.org/economics-finance-domain/ap-macroeconomics/ap-financial-sector/banking-and-the-expansion-of-the-money-supply-ap/a/banking-and-the-expansion-of-the-money-supply

- https://www.ffiec.gov/nicpubweb/content/help/institution%20type%20description.htm

- https://www.banks.com/articles/banking/where-banks-put-money/

- https://www.linkedin.com/pulse/how-banks-really-make-money-closer-look-profit-victory-ikpeme

- https://www.health.com/money/how-much-money-do-you-need-to-be-happy

- https://finance.yahoo.com/news/4-most-popular-banks-millionaires-150054420.html

- https://www.cbsnews.com/news/are-high-yield-savings-accounts-still-worth-opening/

- https://www.investopedia.com/articles/07/roots_of_money.asp

- https://quizlet.com/164526675/econ-macro-test-3-chapter-12-flash-cards/

- https://www.resbank.co.za/content/dam/sarb/what-we-do/prudential-regulation/functions-of-the-prudential-authority/licensing/Banking%20licencing%20in%20the%20Republic%20of%20South%20Africa%20(2021%20update).pdf

- https://finance.yahoo.com/news/banks-money-deposit-110024843.html

- https://study.com/academy/lesson/banking-system-definition-types.html

- https://www.internationalstudentloan.com/resources/understanding-us-banking-system.php

- https://catalog.usmint.gov/faqs/paper-currency-and-engraved-prints/

- https://www.citizensbank.com/learning/multiple-checking-account-benefits.aspx

- https://time.com/personal-finance/article/how-credit-card-companies-make-money/

- https://quizlet.com/135767028/the-banking-industry-flash-cards/

- https://firstutahbank.com/what-is-the-difference-between-banking-and-finance/

- https://en.wikipedia.org/wiki/Post-capitalism

- https://www.linkedin.com/pulse/i-want-own-bank-how-much-capital-would-need-start-mergerscorp

- https://staxpayments.com/blog/future-of-money/

- https://www.quora.com/How-does-a-moneyless-society-work

- https://www.nerdwallet.com/article/banking/how-to-open-a-bank-account-what-you-need

- https://www.takingcharge.csh.umn.edu/can-money-buy-happiness

- https://surferseo.com/blog/cost-to-start-digital-marketing-agency/

- https://portal.ct.gov/DOB/Consumer/Consumer-Education/ABCs-of-Banking---Banks-and-Our-Economy

- https://www.bankrate.com/banking/what-banks-do-with-deposits/

- https://moneyview.in/savings-account/best-banks-for-savings-accounts-in-india

- https://www.marketwatch.com/guides/banking/largest-banks-in-the-us/

- https://finance.yahoo.com/news/minimum-salary-happy-every-state-131450469.html

- https://www.worldbank.org/en/news/feature/2012/07/26/getting_to_know_theworldbank

- https://www.investopedia.com/how-much-cash-can-you-deposit-at-a-bank-8553483

- https://www.freefacts.org/social-security/why-cant-we-just-print-more-money

- https://www.minimaxsasse.se/reset/ufgm33d93a6fy8axihx1lzyme7fsrg

- https://www.investopedia.com/ask/answers/030415/what-distinguishes-financial-services-sector-banks.asp

- https://www.forbes.com/advisor/banking/how-do-banks-work/

- https://www.nerdwallet.com/article/banking/money-market-vs-cd

- https://www.bankrate.com/financing/banking/pictures-of-big-bills-500-1000-5000-10000/

- https://www.investglass.com/how-to-start-your-own-private-bank/

- https://www.quora.com/Why-cant-banks-lend-money-to-itself-to-finance-its-own-acquisitions-of-other-banks

- https://quizlet.com/280915649/economics-chapter-15-money-creation-flash-cards/

- https://www.jagranjosh.com/general-knowledge/list-of-largest-banks-in-the-world-1706509334-1

- https://www.imf.org/en/Publications/fandd/issues/Series/Back-to-Basics/Banks

- https://www.bankrate.com/banking/savings/what-is-a-savings-account/

- https://blog.transparentcareer.com/college-students/career-guides/5-facts-working-commercial-banking/

- https://finance.yahoo.com/news/much-money-millionaires-put-checking-120013872.html

- https://www.quora.com/Why-dont-banks-franchise

- https://www.investopedia.com/terms/d/deposit_multiplier.asp

- https://www.toppr.com/ask/question/do-you-consider-a-commercial-bank-creator-of-money-in-the-economy/

- https://www.quora.com/Can-human-beings-live-without-money-or-a-system-of-economy

- https://www.aba.com/about-us/our-story/aba-history/1782-1799

- https://www.fool.com/investing/stock-market/market-sectors/financials/bank-stocks/how-banks-make-money/

- https://study.com/academy/lesson/how-money-is-made-understanding-bank-lending-in-the-economy.html

- https://georgettemillerlaw.com/how-do-banks-make-money-with-your-money/

- https://lendedu.com/blog/why-money-is-important/

- https://www.quora.com/Can-there-be-Capitalism-without-money

- https://en.wikipedia.org/wiki/Non-monetary_economy

- https://joinhandshake.com/blog/students/major-banks-career-path/

- https://www.experian.com/blogs/ask-experian/how-to-avoid-bank-fees/

- https://www.cnet.com/personal-finance/banking/advice/the-biggest-banks-in-the-us/

- https://en.wikipedia.org/wiki/United_States_dollar

- https://courses.lumenlearning.com/wm-macroeconomics/chapter/how-banks-create-money/

- https://homework.study.com/explanation/can-you-imagine-a-world-without-money.html

- https://www.stlouisfed.org/education/economic-lowdown-podcast-series/episode-9-functions-of-money

- https://www.quora.com/What-is-the-most-profitable-financial-product-for-retail-banks

- https://www.usnews.com/banking/articles/what-types-of-bank-accounts-are-there

- https://www.qulix.com/wp-content/uploads/whitepapers/How_much_does_it_cost_to_build_a_new-age_digital_bank.pdf

- https://www.cbsnews.com/minnesota/news/good-question-how-did-the-u-s-debt-get-so-high/

- https://www.marketwatch.com/picks/these-2-high-yield-savings-accounts-are-paying-6-17-right-now-plus-8-others-with-the-best-rates-for-february-2024-3f2aa25a

- https://www.ziprecruiter.com/Salaries/What-Is-the-Average-Bank-Owner-Salary-by-State

- https://www.elsevier.es/es-revista-economia-informa-114-articulo-the-persistence-poverty-in-capitalist-S0185084916300330

- https://www.usatoday.com/story/money/personalfinance/2023/09/08/cost-of-happiness-by-country-cities/70771946007/

- https://www.investopedia.com/ask/answers/041015/how-do-interest-rate-changes-affect-profitability-banking-sector.asp